Is Ideanomics going out of business? Yes, Ideanomics Is going out of business, as the stock exchange NASDAQ has warned the Electric Vehicle and fintech company that IDEX cannot comply with NASDAQ rules in the future.

As we all know, none of the notices has come into effect immediately. Similarly, the notice given by NASDAQ has no immediate effect, and it grants the company 60 days to hand over a plan.

It is cleared already; if the company is no longer compliant with the rules, then it will be removed and not compliant with its rules in the future.

When asked for a reason, the company broke the ice, “We need additional information and investigation in order to complete the company’s China operation audit, this is the primary reason for delays.” It was noted that the company suffered the most and dropped its share price to 1.04 US dollars, and again, it dropped to 0.95 US dollars by March 22 2023.

So, If you are looking for a blog that contains all information about Ideanomics, including what is Ideanomics, what happened to Ideanomics, and what is its future? Then, you have come to the right (If not, you may be at the wrong place), where we’ve got you covered. So, are you ready to explore this blog!! What to wait, then? Let’s get weaving!!

DiscontinuedNews is impartial and independent, and every day, we create distinctive, world-class programs, news, and content that inform, educate and entertain millions of people worldwide.

What Is Ideanomics & Why Is It Different From Other Electric Vehicle Companies?

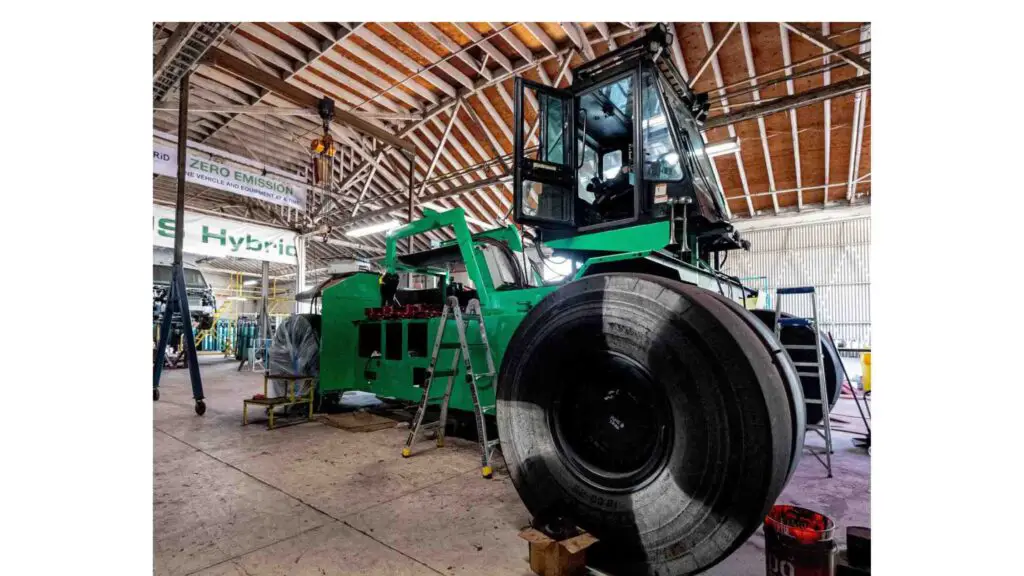

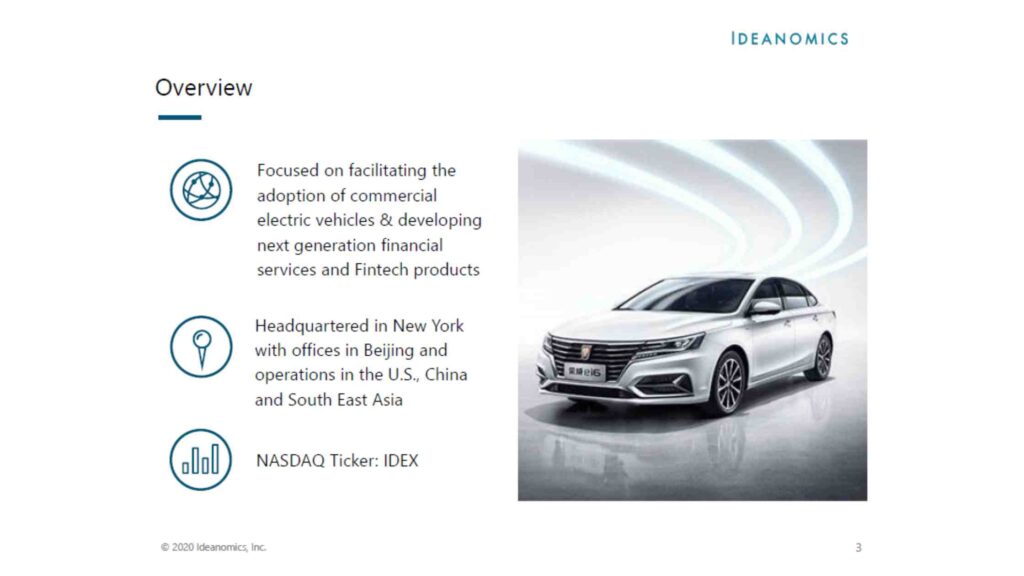

Ideanomics, Inc. is an electric vehicle company founded in New York City, New York, in the U.S. This company has five subsidiaries: Treeletrik, US Hybrid, Wave, VIA Motors, and Solectrac.

It is a non-profit organization that provides commercial electric vehicles and related sustainable energy consumption. IDEX is a CALSTART member that mainly aims to produce clean transportation and invest in maintaining the latest technology deployment.

The company offers finance, leasing, turn-key vehicle, and energy management services for commercial fleet technologies.

This E.V. company has two operations one is Ideanomics Mobility, and another is Ideanomics Capital. Ideanomics Mobility means providing services to the auto sector. Ideanomics Capital is aimed at fintech solutions for financial services.

Ideanomics differs from other E.V. companies as its two operations collectively provide the world’s no.1 technologies and services globally. It provides services to create efficiency, accountability, and transparency; along with these, it gives a chance to the shareholders to become a part of high-potential growth organizations.

What Happened To Ideanomics?

The E.V. company Ideanomics declared on November 4, 2021, that WAVE (one of its subsidiaries) launched a wireless E.V. charging technology at APTA TRANSform Conference & EXPO in Orlando to get high potential from their customers.

This E.V. charging technology represents high power no. Wire chargers are featured hands-free and ready to go.

WAVE’s new technology features wireless E.V. charging service for transit customers, hands-free ports, and warehouse applications. It also launched its other ranges of technologies, such as battery electric buses that work without any human approach or mechanical contact. So, no need to worry about plug-in and overhead charging systems.

This way, Ideanomics emerged in introducing Electric Vehicles. And the stock dropped 55 per cent on a year-to-date record. It was noted that in the quarter of a year, the E.V. company’s team offered 2,314 vehicles and 3,493 vehicles in the fourth quarter of the same year.

Ideanomics had the chance to be filed for bankruptcy, representing that the company suffered from financial issues. Financial distress will likely occur over the next two years of operations.

It is supposed that IDEX has dropped by 95 per cent from its “meme stock” high.

What Companies Are Ideanomics Competitors?

Ideanomics is one of the best Electric vehicle companies with several rival companies, including IPwe, HashKey, Phlo Systems, and Tribal Credit. Ideanomics is mainly aimed at the production and distribution of digital assets.

Ideanomics is a company whose leadership team comprises professional members from the most popular auto industries, such as G.M. and Tesla.

What Is The Future Of Ideanomics?

According to reports, it has been noted that Analysts did not provide long-term Ideanomics stock forecast.

Let’s compare the revenue to the market. The reports have predicted that IDEX revenue (expected to be 38.3 per cent every year) will grow faster than the market in the U.S. (revenue expected in the U.S. market is 7.6 per cent every year).

The future looks impressive as the revenue grows faster than 20 per cent annually.

Although algorithm-based forecasts may or may not always be right, if we look at algorithm-based service predictions, the share rates dropped from 0.79 US dollars to 0.64 US dollars by March of next year.

Nothing can be forecasted perfectly, so we have assumed Ideanomics’ future.

One of the analysts provided a year’s price forecast for Ideanomics Inc. It stated that the company has a median target of 1.00 and high and low estimates of 1.00 and 1.00, respectively. The median estimate showed an increase of +2,286.63 per cent from its list price of 0.04.

The Bottom Line

In the last, we concluded that Ideanomics should be filed for bankruptcy. Suppose we have a look at the forecast provided by the analysts. In that case, it shows that Ideanomics is about to leave the business because it suffered financial losses due to the coronavirus pandemic.

So, the company Ideanomics is supposed to be delisted from the NASDAQ listing rules because IDEX delayed filing its financial reports.

It was noted that the company earned revenue from its electric vehicles and charging products and services sales the previous year (2022) was 68.3 million U.S. dollars. In contrast, the company earned 39.9 million U.S. dollars in 2021.

It indicated that the growth is uniform and continued year-on-year growth. If we talk about full-year gross profit, it was negative 0.8 million U.S. dollars compared to the previous year’s gross profit of 23.2 million U.S. dollars.